40+ do mortgage payments decrease over time

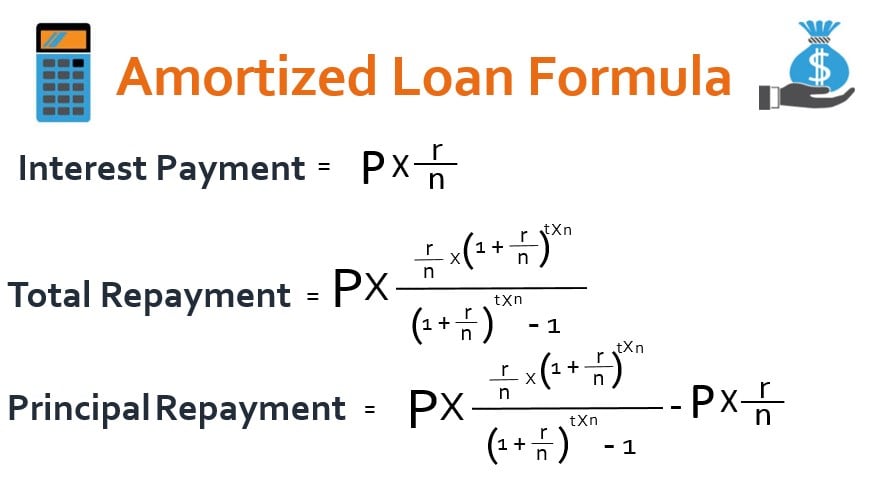

Web Over time as you pay down the principal you owe less interest each month because your loan balance is lower. Web Do Mortgage Payments Go Down Over Time.

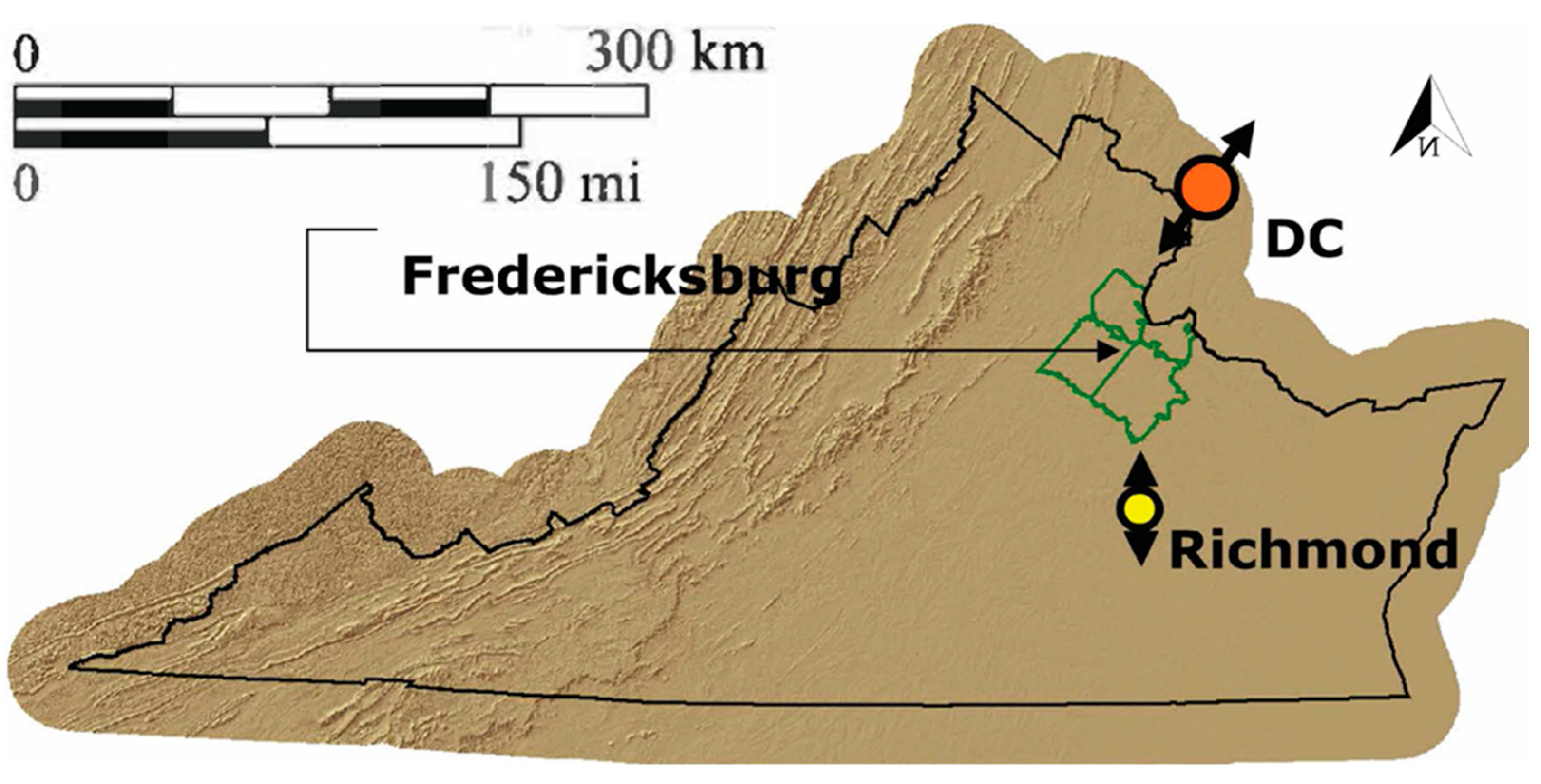

Land Free Full Text Optimal Regional Allocation Of Future Population And Employment Under Urban Boundary And Density Constraints A Spatial Interaction Modeling Approach

Comparisons Trusted by 55000000.

. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Ad Calculate Your Payment with 0 Down. Web Any extra payments will decrease the loan balance thereby decreasing interest and allowing the borrower to pay off the loan earlier in the long run.

Web Figuring out which mortgage offers will be best when youre buying a home is an important decision but know that there will also be ways to lower your monthly mortgage payment. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Web My understanding is that mortgage payments do not decrease over time. Web If you recast your mortgage the lender will use your adjusted principal balance after the payment approximately 345000 and create a new amortization schedule over the. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service.

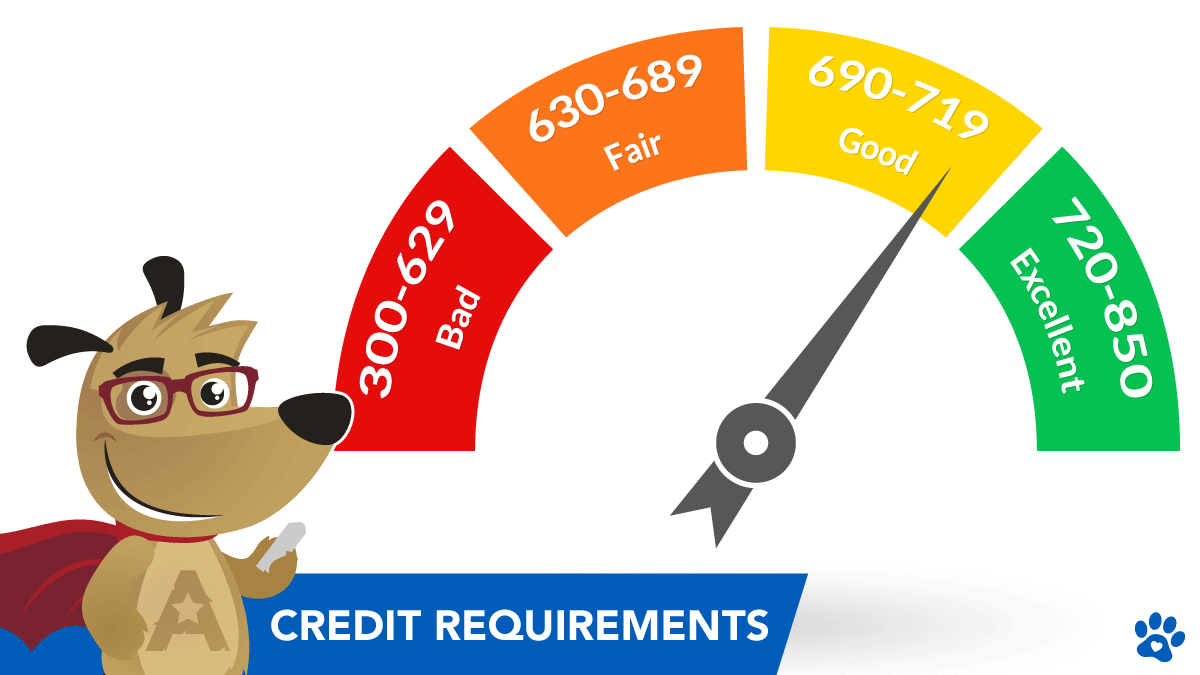

Web In 2022 a 20 down payment is desirable mostly because if your down payment is less than 20 you are required to take out private mortgage insurance. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Learn more about escrow payments.

You start by primarily paying interest and finish by primarily paying principal and this is structured in. Web As your principal balance decreases your interest goes down as well. You could potentially save thousands of dollars in interest over the life of your loan by paying down your.

With a typical fixed-rate loan no your mortgage payment will not decrease over time. You have a decrease in your interest rate or your escrow payments. It could also be because you stopped paying for private.

Web I am planning to purchase a home and all calculations and the banks say principal interest property tax plus mortgage insurance will be close to 1000 per. Web You can also lower your monthly payments during the life of your loan in several ways like increasing the amount that you pay in principal on a monthly basis or. Web Your PMI payments decrease over time as you pay down your loan and build equity.

Ad How Much Interest Can You Save By Increasing Your Mortgage Payment. Ad 10 Best Home Loan Lenders Compared Reviewed. Web In addition to a downward adjustment of an adjustable rate and the possibility of property taxes or homeowners insurance premium decreases covered in earlier.

Get Instantly Matched With Your Ideal Mortgage Lender. In fact the federal Homeowners Protection Act mandates that once your home. Lock Your Rate Today.

Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. So more of your monthly payment goes to paying. Some people form the.

However your mortgage payments.

:max_bytes(150000):strip_icc()/GettyImages-157612066-37897f1a9ce648ad82e003fc9be5cd31.jpg)

Why Is Most Of My Mortgage Payment Going To Interest

S P Will Drop Below 4 000 As A Recession Shock Approaches Bofa Seeking Alpha

Why Is The Cost Of Living Significantly Lower In China Than In The Us Quora

Digital Mortgage 2017 National Mortgage News Conferences

Can I Get A Housing Loan Of 40 Lakhs As My Salary Is 55 000 Quora

Families In Eu 15 A Sterreichisches Institut Fa R Familienforschung

Amortized Loan Formula Calculator Example With Excel Template

Mortgage Fundamentals An Illustrated Tutorial

How To Save On Your Mortgage As The Cost Of Living Increases John Charcol

Credit Requirements For A Reverse Mortgage In 2023

Is A 35 Year Mortgage Right For You

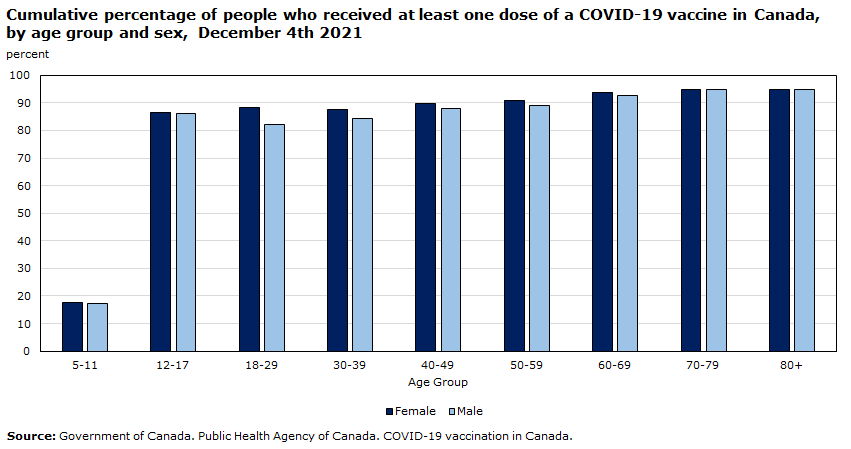

64th Isi World Statistics Congress Ottawa Canada Submissions Isi

:max_bytes(150000):strip_icc()/GettyImages-1081824440-5c8c4cfd46e0fb000177005a.jpg)

5 Reasons Your Monthly Mortgage Payment Has Changed

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

:max_bytes(150000):strip_icc()/couple-talking-with-financial-advisor-140890269-577b283b3df78cb62c98fec1.jpg)

Pros And Cons Of A 40 Year Mortgage

Covid 19 In Canada Year End Update On Social And Economic Impacts

Biggest Weekly Mortgage Rate Drop In 40 Years Is Good News For Buyers